Education • What is the alligator indicator, and How to use it for free in 2022?

The Alligator indicator is one of the top favorite indicators of many traders of all sizes and experience levels.

You can use it to get a good signal to base your trades on, depending on your trading strategy. But there is a lot that goes into trading with this indicator. There are a few important things that you need to learn, from what is the alligator indicator, how it works to how to use it in forex trading.

If you are interested in using the Alligator indicator in your forex trading, keep reading to learn everything you need to know about it.

The Alligator indicator is a technical analysis tool that helps to confirm current price trends and their primary direction. This tool was introduced by the trader Bill Williams who was a pioneer of market psychology and the creator of several other indication tools.

In addition to trend identification, the Alligator indicator is capable of aiding traders in entering counter-trend moves according to the market condition.

This indicator uses a smoothed average calculated with a simple moving average to begin the process. Furthermore, there are three moving averages that make up the Jaw, Teeth, and Lips of the Alligator, which are set at five, eight, and 13 periods. We'll talk more about them in a bit.

The Alligator indicator also builds up trading signals by applying convergence-divergence relationships. Moreover, the indicator is made up of a combination of moving averages that uses nonlinear dynamics. When done correctly, traders will be able to see accurate results with lips making the fastest turns and Jaw making the slowest turns.

As with anything, the alligator indicator also has some drawbacks in addition to its pros. Having a clear understanding of them can help make the implementation process much easier and allow you to know what to expect.

Here are some of the pros and cons of the alligator indicator,

One of the first things that any trader should do before using the alligator indicator is to identify its three balance lines. These balance lines or moving averages comprise the Alligator's Jaw, teeth, and lips.

Let's look a bit deeper into each balance and see what they describe.

Since the meta trader platforms take care of most of the calculations for you, the importance of a precise method of calculating the moving averages in the alligator indicator lowers. By observing these lines, traders can identify the alligator's state and, therefore, the state of the market.

A lot more goes inside the Alligator indicator than what meets the eye. To gain a better understanding of what the indicator does, first, you will need to understand how the indicator calculates the market movements.

The formula of the Simple moving average of the indicator is as follows,

Subsequent values are:

The calculation of each of the balance lines is as follows,

List of acronyms

At first glance, this all might seem a bit confusing and hard to understand. But do not worry; the alligator indicator does the calculations and brings results to you as lines of a graph. This is just to help you understand what is happening behind the curtains.

Before getting into using the indicator, you must understand and learn how to read the Alligator indicator and its data. Moreover, there are a few things that any trader must do if they are to get the best out of the indicator.

Using the Alligator indicator when the price of an asset is consolidating is not ideal. Therefore, traders must always look if the price of the asset is moving up or down on the charts.

If there is a clear movement in the market, traders can then use this indicator to predict the movement of the market more clearly.

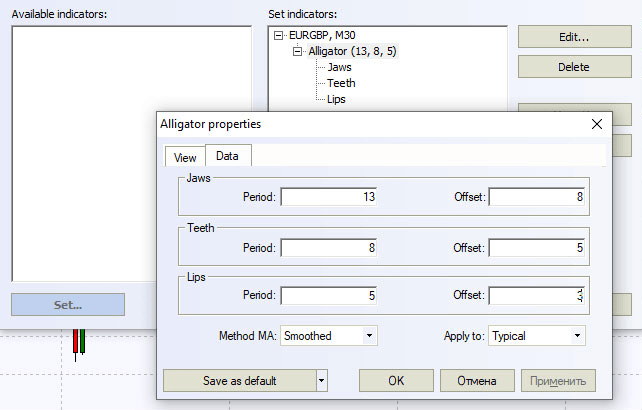

Numbers that are in the indicator are what give you the information that you need to make better trades. So, it is obvious that you should have a clear understanding of what those numbers are and their meanings.

Each of the balance lines comes with a default period of its own. For jaws, this is 13, for teeth, it is 8; and for lips, it is 5. Next on the list are the shifts of each balanced line. This value shows the periods that lines are moving onto. The default values are 8 for jaws, 5 for teeth, and 3 for lips.

Next on the list is the available methods of calculation. This changes how the indication is carried out and changes according to the preferences of the trader. By default, this value is set to smooth.

In addition, traders also have the freedom to choose from simple, linear weighted, and exponential methods.

The last thing to pay attention to is where you want to apply for these numbers. This can determine where the application of the inserted values should be placed and take effect.

Traders have the freedom to choose from close, open, high, low, median, weighted close, and typical close options.

Tip: We highly recommend that you use the default figures just to make sure that you don't make any costly mistakes while using the alligator indicator.

There are a few ways that traders can follow when using the Alligator indicator. These can help traders determine when to trade and when to pull out. They are,

Let's talk about each of the above trend aspects in more detail.

This is when the market is not doing anything and awaiting a change. This is very common within the forex market and can happen often.

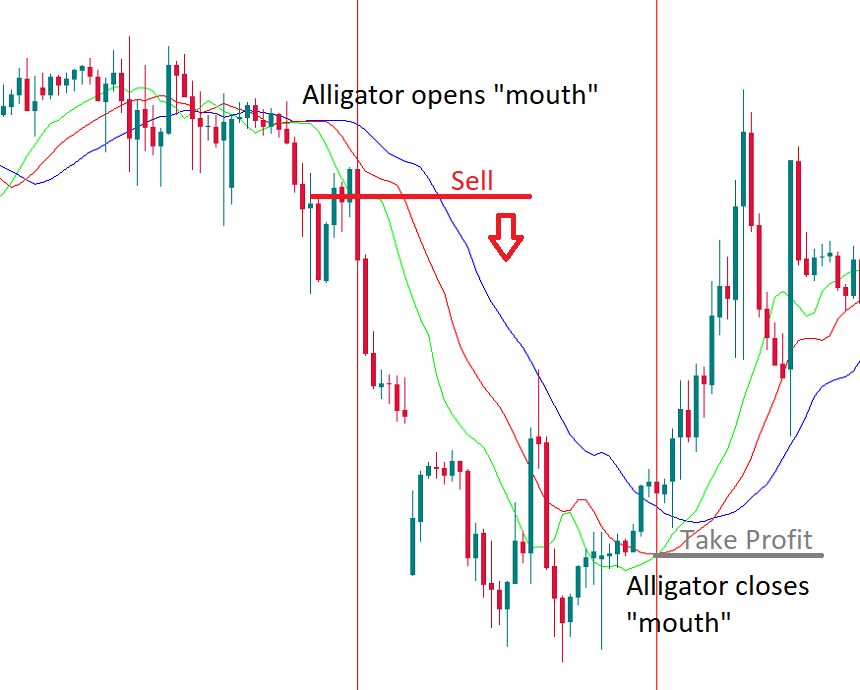

The easiest way to identify the absence of a trend is when all three lines of the Alligator indicator are entwined or very close together. This is what traders also call the alligator, being dormant and awaiting a change in market state.

When there is a movement in the market, that can be due to a formation of a trend. In scenarios like this, the green lip line crosses through the slower ones while the slower ones follow the same direction but spread apart.

In addition, this signals that the alligator is eating. The more time spent dormant, the hungrier it gets. This exact scenario is when traders can get the most out of the Alligator indicator.

Identification of the direction of the trend is simple with the help of the balance lines.

Understanding the line movements is one of the easiest ways to get a grasp of the market movements and better speculations. This is also one of the key strengths of the Alligator indicator, and the drawback of it can be successfully reading the opening signals on time.

On the Navigator window or the 'Insert' menu under the 'Bill Williams' folder, you will be able to find the Alligator indicator for meta trader 4.

All you have to do is drag and drop that indicator into your preferred chart. When you drag and drop, you will see a dialogue box with tools to modify the parameters of the indicator.

We recommend that you keep things default as most of the guides online will focus on the default parameters.

Same as with the meta trader 4 version, the process of using the Alligator indicator with the meta trader 5 is the same.

On the Indicators folder in the navigator menu, you will find the Bill Williams folder, and within it is the indicator that we are looking for. Select the alligator and set the parameters and color schemes (better to leave defaults).

While this indicator is good at what it does, it always has room for improvement. The best way to ensure the maximum quality results is by combining this indicator with other indicators that fulfill unique niches.

You can also use an indicator of another methodology to check whether the results provided by the Alligator indicator are accurate. Furthermore, using a momentum indicator can help verify the veracity of your trading signals.

One of the better examples of compatible indicators that work well with the Alligator indicator is the MACD indicator. This can help to filter out signals and confirm buy and sell signals to maintain accuracy.

It is a technical analysis tool that helps traders to confirm current price trends and their primary direction.

The Alligator indicator can help traders to decide the movements in the forex market. This can provide traders with better buy and sell signals resulting in more profitability.

The Alligator indicator was introduced by the legendary Bill Williams. He is an early pioneer of market psychology and author. He has also created many other analytical tools.

Although the alligator indicator can be somewhat confusing to absolute beginners in forex trading, intermediate and expert traders can easily use this in their trades to make accurate predictions. You can always combine this with other indicators to improve its effectiveness and confirm your signals.

However, we advise keeping in mind the drawbacks of the indicator as well, so you are not making your trades solely based on the tool. We hope this article helps you understand how the alligator indicator works and how to use it in your trades.