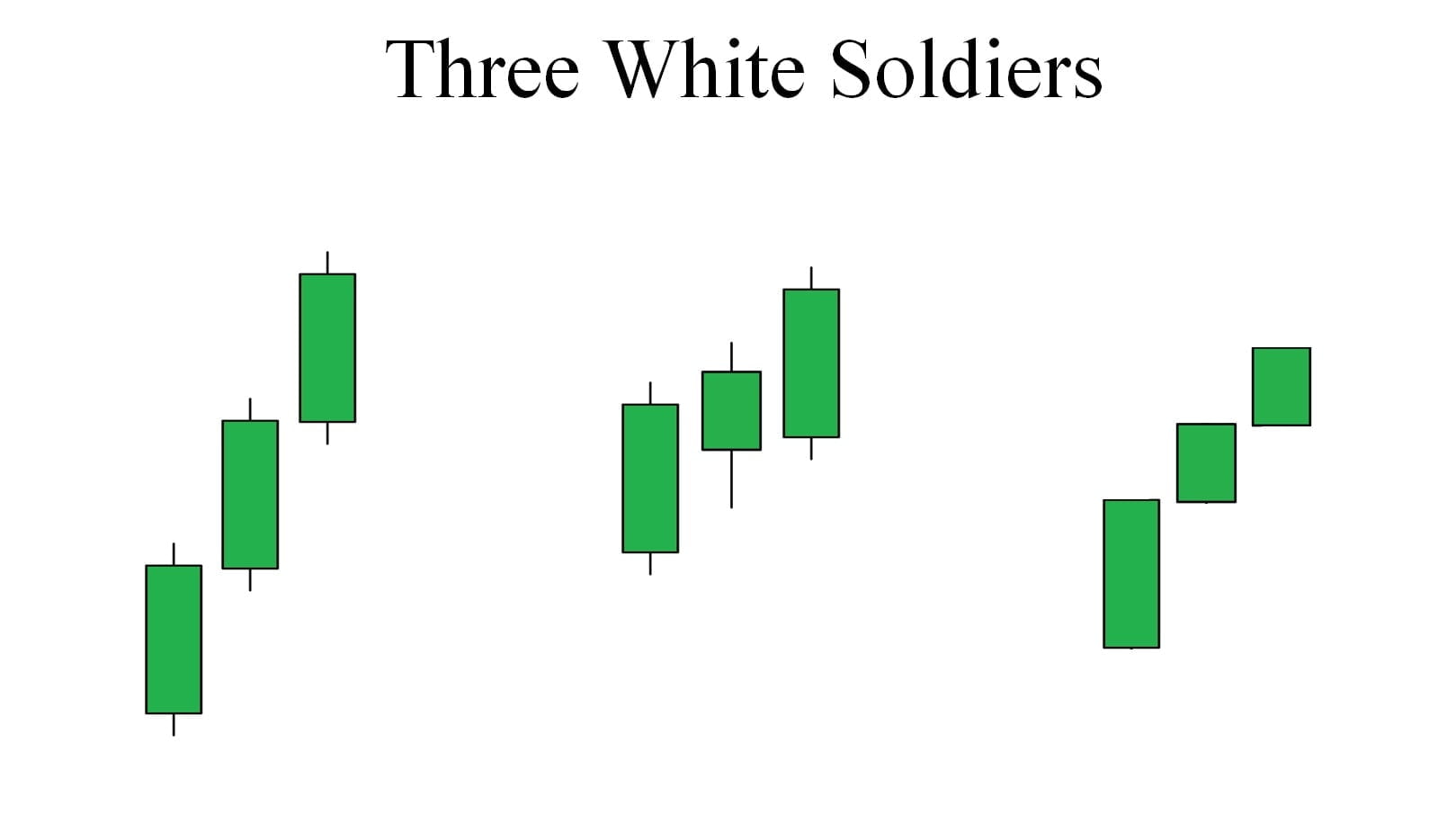

Education • How to trade with three white soldiers in 2022?

Three white soldiers is a popular candlestick pattern that many traders use in their trading. It is easy to identify and offers reliable insights into the market when used correctly.

Regardless of the trading strategy you are using, being able to read candlestick charts can give you an edge on trading decisions. There are many candlestick chart patterns every trader should know of, and three white soldiers are one of them.

So let's look at how to identify this candlestick pattern and how to use them in trading to make the best profits.

The three white soldiers is a candlestick pattern that forms at the end of a downtrend in the market.

As the name suggests, this pattern consists of three long bullish candlesticks that signal strong buying pressure. When this occurs, buying pressure tends to surpass the selling pressure by a decent margin.

In other words, when this formation occurs, the bulls overtake bears. When bulls are in control of the market, you can see multiple long bullish candles near one another.

So most of the time, the three white soldiers are a pattern that signals the bullish reversal probability in the market.

However, depending on where the pattern forms, this can also act as a continuation pattern.

For instance, if this pattern forms at the end of a bullish market, it can appear as a continuation pattern. However, when the pattern forms at the end of a downtrend, it often reverts to its original bullish reversal state.

So with the correct implementation, three white soldiers can help traders who view the market from a supply and demand perspective to identify the shift in market sentiment.

To get a better understanding of this candlestick pattern, you must understand the characteristics of the pattern. They are,

To further extend your knowledge about the three white soldiers, you need to understand both its advantages and limitations.

This can help you to be more aware of the market state and take early precautions to prevent any unfortunate events. With that being said, let's take a look at the pros and cons of this pattern.

Consequent three bullish long green candles are not present in any other candlestick pattern. So the three white soldiers pattern is unique, and therefore it is easier to identify than most candlestick patterns.

High accuracy Out of all the candlestick patterns, three white soldiers tend to be on the more accurate side. The formation of these marks the end of a downtrend and signals the price reversal due to high buying pressure.

This pattern can show this with high accuracy, and with the help of other confirmation methods, traders can further validate the price movement prediction.

The 3 white soldiers pattern works well with both short-term and long-term traders. This allows this candlestick pattern to be a bit more flexible than most other indicator patterns.

Since three white soldiers can provide signals in both short-term and long trades, the possibility of false signals rises. These most commonly appear in middle price range consolidation mode.

This pattern does not signal a complete price movement reversal in the market. Moreover, it may only signal a pause in the current trend that travels in the same direction.