Education • What are the best swing trading indicators?

Market swings often present many opportunities to make a profit. However, in order to capitalize on them, you need to work with the best swing trading indicators.

There are many trading strategies out there, and swing trading is one of them. If you found swing trading interesting and have already done some research, you should know, at this point, that there are many indicators that you can use for swing trading.

So what are the best swing trading indicators? How to use them correctly?

This article breaks down 7 top swing trading indicators to help you put together your swing trading strategy.

Benefiting from small price moves within a more significant trend is the strategy behind swing trading. This attempt to gain short- to medium-term profits can last from a few days to several weeks.

Suppose traders are to anticipate the price movements of the assets correctly to help the chances of swing trading. In that case, they will have to use both of the analysis methods with a heavy emphasis on technical analysis.

Swing traders tend to focus more on the points at which price momentum switches direction and buy or sell an asset to get the most profit.

The great thing here is that swing traders can also use the stop losses and profit targets to set an established risk/reward ratio. In addition, traders can get the help of some of the best swing trading indicators to accurately speculate on the price movements of the assets.

When taking part in swing trades, traders are exposed to weekend and overnight risks. This occurs due to the possibility of sudden price changes that open the following session at a different price.

Situations like this can either result in substantial losses or substantial profits to the gains of the trader.

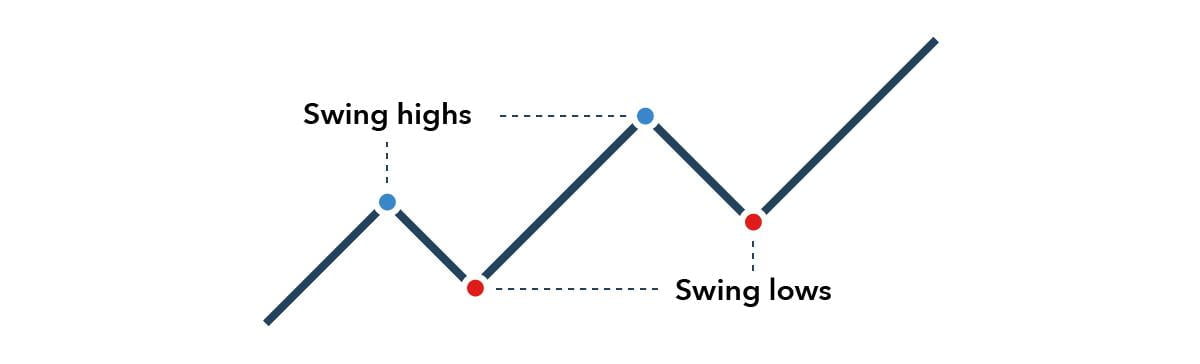

Two swings can help a trader to identify their next cause of action easily. They are,

Swing trading is a strategy that traders use in many financial markets like stock and crypto, besides forex. But the high liquidity, tight spreads, and 24-hour-a-day nature of forex markets make it the ideal place for swing traders to thrive in.

As a result, many traders who practice swing trading as their main trading method tend to flock to the forex market.

Taking part in forex trading can have its own merits as well as drawbacks. While some traders prefer the swing trading environment, others prefer other methods like day trading to swing trading.

The best way to be certain about what you want to do is by understanding the benefits it provides and the drawbacks it comes with. Here is a list of the pros and cons of swing trading.

When compared with other short-term trading strategies like day trading, swing trading has a much smaller time commitment requirement.

When doing day trading, traders need to be glued to their screens and must pay attention to the market all the time. But in swing trading, all you have to do is get your technical analysis right, and you will be able to save much of your time.

Since you don't need to stare at a screen for the majority of the day, you will have much more free time on your hands. For people who are engaged in full-time jobs, swing trading will provide a great opportunity to make an additional income in their free time.

Having a steady stream of income in addition to your trading earnings is always a good thing. Since you can't be 100% sure about the profits of trading every time, it is wise and will also help your trade funding to have a full-time job.

Utilizing technical analysis rather than depending on fundamental analysis can make the swing trading process much easier. It also allows traders to set up stop loss orders or gain profit orders, leading to a simple trading practice.

Swing trading also is an agile solution that provides a favorable environment to both short and long-term traders.

Swing trading is one of the best ways to maximize your profitability when doing forex trading. When a trader is using proper risk management, a good strategy, and some of the best swing trading indicators, making profits with swing trading becomes much easier.

Moreover, swing trading does not tie down your capital for long. Also, traders can expect earnings of 10-50% per annum.

Most of the time, swing traders have to keep their traders open overnight or over weekends. Also, with the high volatility of the forex market, significant price fluctuations can occur over weekends or overnights.

In cases like this, swing traders face the risk of having a great impact on their trades.

Even though swing trading does not cost as much as day trading, the costs of constant trading can add up to a reasonable sum. Moreover, it is a well-known fact that timing the market swings is very difficult. If the trade does not return as expected, it will add to the costs without any returns.

Since swing traders profit from individual price swings in the short term, they miss out on a great forex pair that would have been more profitable in the long term. Most of the stale and the highest liquid pairs tend to be better long-term investments rather than short-term ones.

To be a successful swing trader, you will need to make the best use of the technical analysis you possibly can.

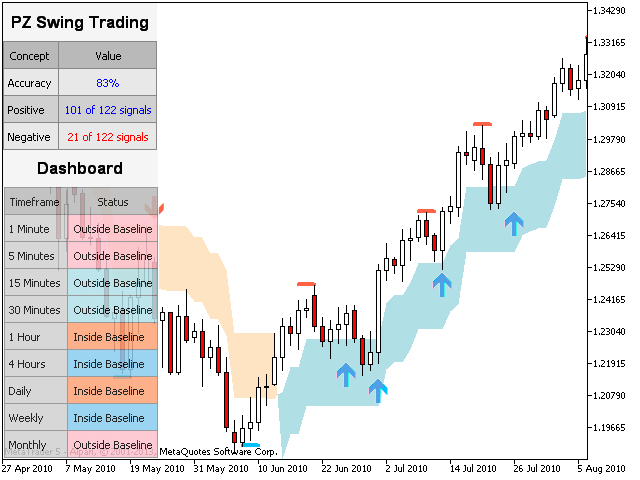

One of the most well-recognized methods is the usage of swing trading indicators. These indicators are technical analysis tools that help traders to identify new trade opportunities.

Since swing traders rely on making a profit off of mini trends and the price fluctuations that follow them, they will need to be on top of these trends as quickly as possible.

With the best swing trading indicators, traders can identify and take steps to make the most of the mini trends that arise in the market.

Let's take a look at some of the best swing trading indicators.

The moving average (MA) is one of the oldest and most used trading indicators that has been around for decades. This indicator uses moving averages to calculate the average price movement of any given asset over a given period. So this indicator has the ability to smooth out the complexities of short-term volatility.

There are two types of MAs, and they are simple moving averages (SMAs) and exponential moving averages (EMAs).

The SMA focuses on past price action, while EMA emphasizes the more recent price action. With MAs, traders gain the ability to understand short, medium, and long-term MAs, depending on the monitoring period.

At the current times, these are a bit outdated and laggy. Therefore, the best use of MA is used as a confirmation tool for other indicators.

These are a type of momentum indicator that traders can use to predict the price movement of any given asset. Stochastic oscillator functions by comparing the closing price of an asset to the range of its prices over a certain period.

This indicator represents its data to the trader in the form of a chart from 0 to 100.

The specialty of the Stochastic oscillator is its ability to display the overbought and oversold zones. These values are noted as above the 80 lines for overbought and below the 20 lines for oversold. This also displays two lines that show the value of Stochastic and the 3day moving averages.

This is one of the best swing trading indicators to determine the oversold and overbought levels of an asset.

As with any other momentum indicator, RSI marks the potential oscillations within a broader trend to make them known to the swing traders. RSI functions by calculating the size and magnitude of the recent price fluctuations within the market.

This indicator acts like an oscillator, and traders use this to understand the overbought or oversold levels of an asset. Same as the Stochastic oscillator, it offers a graph from 0-100 that shows vital information. In this case, it shows the RSI line to inform the traders of the number and size of bullish closes.

When using the RSI, keep in mind that if the indicator rises above 70, it shows an overbought level. If the indicator falls below 30, that shows an oversold market. Traders can use this information to anticipate uptrend reversals or trend endings.

This indicator allows a better insight into the volume with its relation to the price action. With the help of the ease of movement indicator, traders can identify whether the movements within the market are affected by a low volume of trades.

By using the EOM, traders will be able to make better use of the advancements in the price. If the indicator states a value above 0, it shows that the market price is advancing at a steady pace.

If this value goes below 0, then it shows that the market is falling with increasing ease.

With the correct use of the EOM indicator, traders will have a better understanding of the market, resulting in better results for swing traders.

Volume is an indicator that is shown directly on the main chart of the forex market by default. This shows the number of traders who take part in buying and selling a given asset at any given time. This information can be useful for traders when understanding how robust a newly formed trend is.

All you have to know to understand the indicator is that if the volume value is high, the trend is much stronger.

This indicator becomes much more efficient when used with breakout strategies.

Even though this is one of the best swing trading indicators, many traders look past it and opt for other ways. So, if you are a swing trader, make sure to use the volume indicator to increase the profitability of your trades.

This also is a momentum indicator that can be very helpful for swing traders. The indicator comes with three lines that show the moving average, positive standard deviation, and negative deviation.

The Bollinger Band is capable of quickly detecting trends, oversold and overbought amounts, as well as volatility.

With BB, swing traders can get a better understanding of the market situation and whether to go short or long on a trade.

In addition, the BB indicator depicts market volatility with its width. If the lines move apart, making the BB wider, the volatility gets higher and vice versa.

In a stable market, the BB line will move towards the center, and the changes to it show the trends that happen within the market.

This indicator functions by merging two regular moving averages. This is a bit more complex indicator and calculated by subtracting the 26-period EMA from the 12-period EMA.

The parameters of the equation can be changed to suit the trader's needs.

There are three main elements of the MACD, and they are,

Traders tend to buy when the MACD line crosses above the signal line and to go short when the opposite happens.

In addition, looking at the divergence between price action and the histogram shows a trend reversal. This is another one of the best swing trading indicators that can help swing traders in their trading activities.

Pro Tip: Using too many indicators will make things overcomplicated and make you overthink your every decision. So our advice is to always keep things simple.

Swing trading indicators are technical analysis tools that help traders to identify new trade opportunities.

Each indicator has its usage. Therefore, the best indicator changes according to the needs of the trader. However, the most used indicator is Moving averages

While they provide enough information to traders to take action, they are not 100% accurate. The accuracy can be increased by using another indicator as a confirmation.

Swing trading is a popular trading method and comes with many advantages. If you, too, like to become a swing trader, the best way to go about it is with swing trading indicators.

Swing traders rely heavily on the points at which price momentum switches direction and the best way to identify these swing trade opportunities is by using reliable swing trading indicators. These indicators allow traders to quickly identify and take necessary actions toward new trade instances.

Swing trading indicators come in many forms, and this guide aims to help you gain a better understanding of the most used ones. Take the information here and select the most suitable swing trading indicator to help increase your chances of success.