Uncategorized • Top 3 Forex Trading Strategies for 2026: How Pros Stay Ahead

The Top 3 Forex Trading Strategies for 2026 are essential for traders who want to gain a professional edge in a constantly changing market. Forex trading in 2026 is being shaped by central bank policies, geopolitical events, and technological advancements. Traders who understand and implement proven strategies can manage risk effectively, increase profits, and stay ahead of market fluctuations.

Whether you are a beginner or an experienced trader, mastering these strategies can help you trade with confidence and consistency.

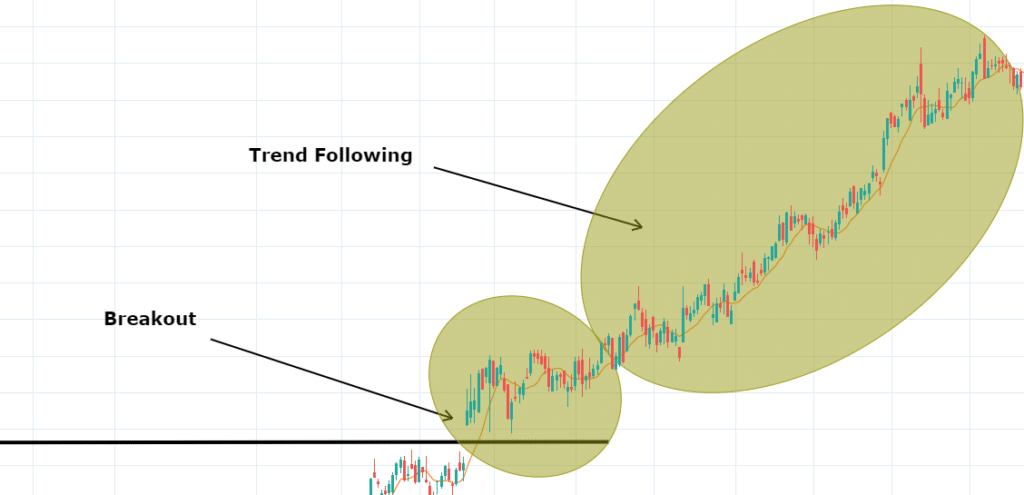

The first of the Top 3 Forex Trading Strategies for 2026 is trend following. This strategy focuses on trading in the direction of market trends using tools such as moving averages, MACD, and ADX to confirm momentum.

Trend following is particularly effective in 2026 due to macroeconomic events that create long-lasting trends. For instance, decisions from the Bank of Japan or Federal Reserve rate adjustments can trigger sustained trends in currency pairs like EUR/USD and USD/JPY.

Pro Tip: Analyze multiple timeframes to identify the overall trend on weekly charts, then refine your entries on daily or 4-hour charts. This reduces market noise and improves accuracy.

Extra Tip: Combine trend following with fundamental analysis. For example, if Eurozone GDP or inflation data supports a strong trend, it increases the likelihood of a profitable trade.

Advanced Insight: Professional traders often use trailing stops with trend following to lock in profits while letting the trend continue.

The second of the Top 3 Forex Trading Strategies for 2026 is breakout trading, which thrives in volatile markets. Breakouts occur when a currency pair moves decisively above resistance or below support, often with higher volume.

Pairs such as GBP/USD and AUD/USD frequently experience breakouts around major economic events like US Non-Farm Payroll releases or Reserve Bank of Australia announcements.

Successful breakout trading requires:

Pro Tip: Be patient and wait for confirmation before entering a trade. False breakouts can cause losses if entered too early.

Extra Tip: Combine breakouts with momentum indicators like RSI or stochastic oscillators to filter high-probability setups.

The third of the Top 3 Forex Trading Strategies for 2026 is the carry trade. Traders borrow low-yield currencies to invest in higher-yield currencies, earning both price appreciation and interest rate differentials.

Pairs like NZD/JPY and AUD/JPY are popular for carry trades in 2026 due to differing interest rates.

Pro Tip: Monitor central bank announcements and geopolitical developments. Sudden policy changes can reverse carry trade positions. Real-time updates from Trading Economics are invaluable.

Advanced Insight: Combining carry trades with technical analysis for entry points increases the chances of profitability while minimizing drawdowns.

Mastering the Top 3 Forex Trading Strategies for 2026 is not just about executing trades—it’s about risk management, discipline, and continuous learning.

By applying these strategies consistently, you can position yourself to take advantage of market opportunities and navigate uncertainty with confidence.

In conclusion, the Proven Top 3 Forex Trading Strategies for 2026—trend following, breakout trading, and carry trades—are your foundation for success. Discipline, adaptability, and informed decision-making are the keys to staying ahead in the forex market this year.

Start you trading journey today: Practice with Demo account