What is Forex Trading? Free Beginner Guide for 2022

Forex trading is a huge topic in the trading world and among the people. Many are intrigued by the high returns forex delivers and see it as a great way to make money easily.

Whether you like to try forex trading to earn some extra cash on the side or to become a professional forex trader, there is a lot that you should learn.

As one of the biggest trading markets in the world, Forex has its upside and downside, and knowing it all only makes you better prepared for your trading journey ahead.

Let's look at what Forex is and how the forex market works. After reading this, you will know exactly how everything works when it comes to Forex.

What is Forex?

The act of trading foreign currency pairs between traders for an agreed price is what forex trading is all about. Forex is also the largest financial market in the world and offers trading opportunities for over 10 million traders and counting.

Forex might seem like a simple method of trading on paper. But when you start to look deeper, you will begin to understand how complex it can get.

For any beginners trying to learn the art of Forex, research is the key.

Let's begin with the types of available forex markets.

Types of Forex Markets

When it comes to the forex market, there are a few ways that traders can follow their traders. If you are a beginner who is learning forex trading, you should know about all the available trading modes for you.

Spot Market

This is where immediate exchange between traders takes place at the current exchange rate. The trades that happen on the spot market require quick payments and need immediate currency delivery or exchange within 48 hours. The currency transactions on spot trades occur two days following the contract date.

Spot traders don’t face the risk of sudden increases or decreases in the price of the forex pair, which can lead to issues in trades. If you are a trader who aims to complete rapid trades in quick succession, the spot market might suit you.

Forward Market

In the forward market, the two parties involved in the trade set a specific date and time for the transaction to take place. Because of this, no money transfers take place when the trade is initiated.

The forward rates are also similar to the rates within the spot market, and the only difference is the delayed delivery.

Besides the currency swap point, the forward market also allows traders to customize the delivery period to suit their needs. With the help of the forward market, importers and exporters can avoid issues that occur due to rate fluctuations.

Future Market

Future contracts are an alternative version of the forward contract, which is traded publicly on a futures exchange.

Similar to forwarding contracts, futures contracts also specify the price and date to exchange an asset, with the biggest difference being the fixed contract size and maturity date.

To take part in a future market, traders will have to pay an initial margin into a collateral account to create a future position.

Most of the time, future trades undergo competitive trading and require an organized exchange to take place.

Swap Market

The allowance of two streams of cash into two different currencies is the idea behind the swap market.

These types of trades allow traders to purchase or sell the same currency for forwarding delivery. This forwarding delivery then follows a simultaneous sale or purchase of spot currency.

There are two main types of swaps available in the swap market. They are

- Swap long - which is for keeping long positions open overnight,

- Swap short - which is for keeping short positions open overnight.

Options Market

Forex options are contracts that allow buyers the right but not the obligation to buy or sell a specific currency at a certain rate before or on a specified date.

On the options market, traders are allowed a call option, which enables traders to buy the underlying asset, while a put option allows the sale of it.

The term exercising the options is common in the options market, and it refers to the buying and selling of the underlying asset through the option.

In contrast, exercising the option is not an obligation for the options traders.

Forex trading terms that are important to know

When you are traversing the forex market as a new trader, you are sure to come across a few words that might seem odd and new to you.

Understanding the lingo and the jargon within the forex market is an important aspect when it comes to learning forex trading. Let’s take a look at the most commonly used words in the forex market.

Base currency

In the forex market, the currencies are traded in pairs to make the transactions much easier.

Within this pair, the base currency is the one that is first listed in the pair. This refers to the currency that you are buying when you trade a forex currency pair. The value of the base currency is always 1 by default.

Quote Currency

Within the forex currency pair, the quote currency is the one that is listed second. It is the currency that you are selling when you trade a forex currency pair.

The value of the quote currency is measured according to the base currency. For example, if the EUR/USD pair is trading at 1.02, the value of the quote currency (USD in this case) is 1.02 USD.

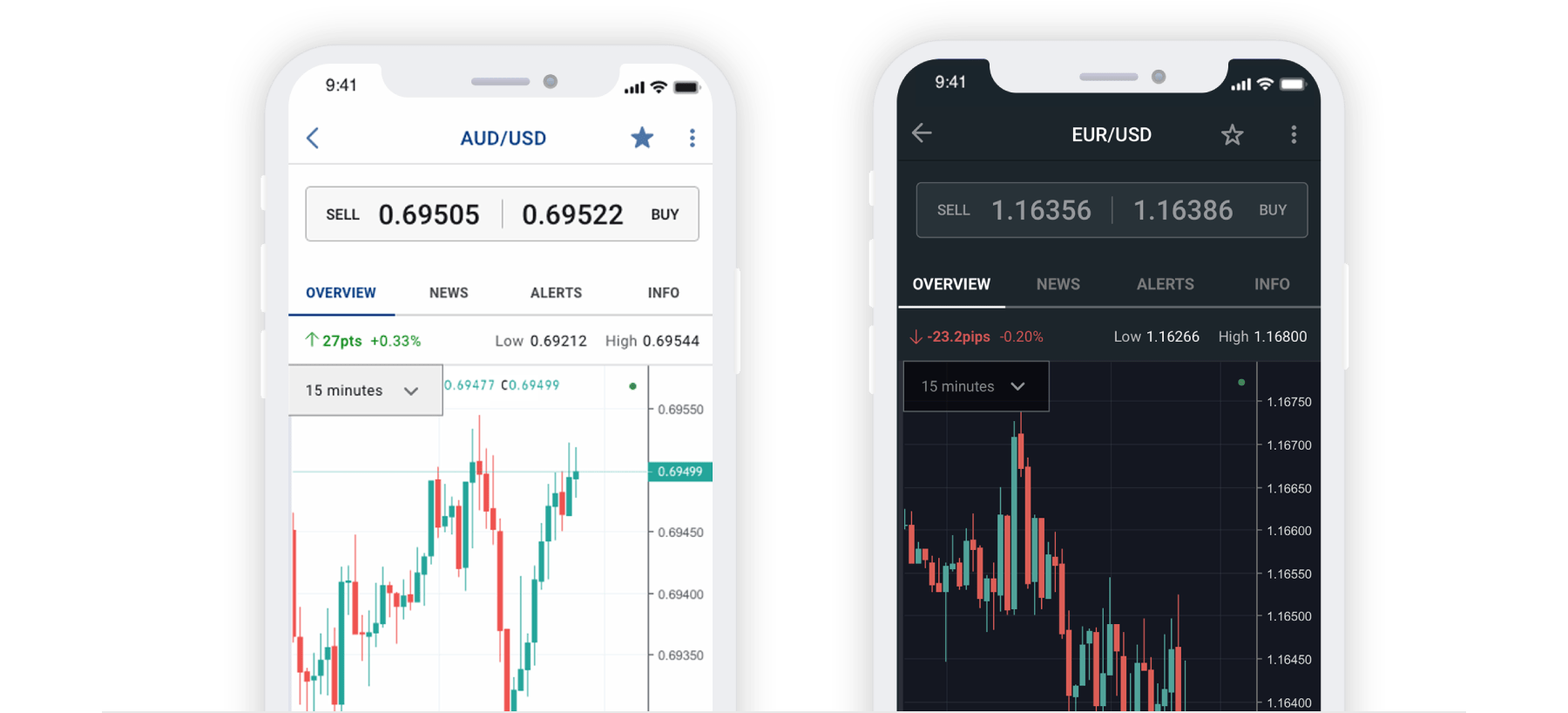

Spread

The spread in Forex refers to the difference between the asking price and the bid price of a certain forex currency pair.

Moreover, to find the spread of any forex pair, all you have to do is subtract the bid price from the asking price. In other words, the value of the spread is the cost of trading.

Leverage

Leverage is a way provided by forex brokers to traders, allowing them to trade in a bigger volume than they normally would.

It is kind of like a loan from the broker, which increases the capital of the trader. However, leverage is a double-edged sword as the buildup of large debt on a weak capital can lead to collapse.

Margin

The margin on the forex market is the amount of money that a forex trader needs to invest in maintaining the position and trade. This acts more like a security deposit than a transaction cost which the broker while trade is going on.

Pip

A pip in Forex is the unit that is used for the measurement to show the change in value between a pair of currencies. For instance, on the EUR/USD pair, if the value rises from 1.02 to 1.03, the pip, or the change in value between the pair, is 0.01.

Currency Pairs in Forex

Within the forex market, there is a large number of foreign currencies available. Most of the national currencies are eligible for trade in the forex market.

Furthermore, to keep things organized and simple to understand, these pairs are split into four categories.

They are,

What is Forex Trading?

Forex is a trading method that pairs up two foreign currencies and proceeds trading from there on. Due to this pair-up, when you buy one currency, you automatically sell the other currency simultaneously.

Here the traders speculate on the market movement of the forex pairs to make potentially profitable trades.

To make a forex trade, first, you must have a currency pair. If you are a new trader, it is recommended that you start with one of the major pairs due to their high liquidity.

Then analyze the market by doing research and analysis with the help of the tools offered by the forex broker you choose. Also, pay attention to trading signals, trends, new market developments, and news as they can help decide the market direction.

Buy positions are for when you believe the base currency value will rise compared to the quote currency value. In contrast, sell positions are when you believe that the base currency will fall compared to the quote currency.

Trading Tip: Since you are a beginner in forex trading use demo accounts to your advantage before making any actual trades. They will help you grasp the basics of the Forex by practice.

[elementor-template id="8318"]

Pros and cons of Forex Trading

Like all other things, forex trading also has drawbacks mixed with its benefits. New traders must understand both pros and cons when starting forex trading.

Pros

Cons

What is a Forex Broker?

It is very hard for individual retail traders to make trades in the forex market on the OTC method. This is where forex brokers come in.

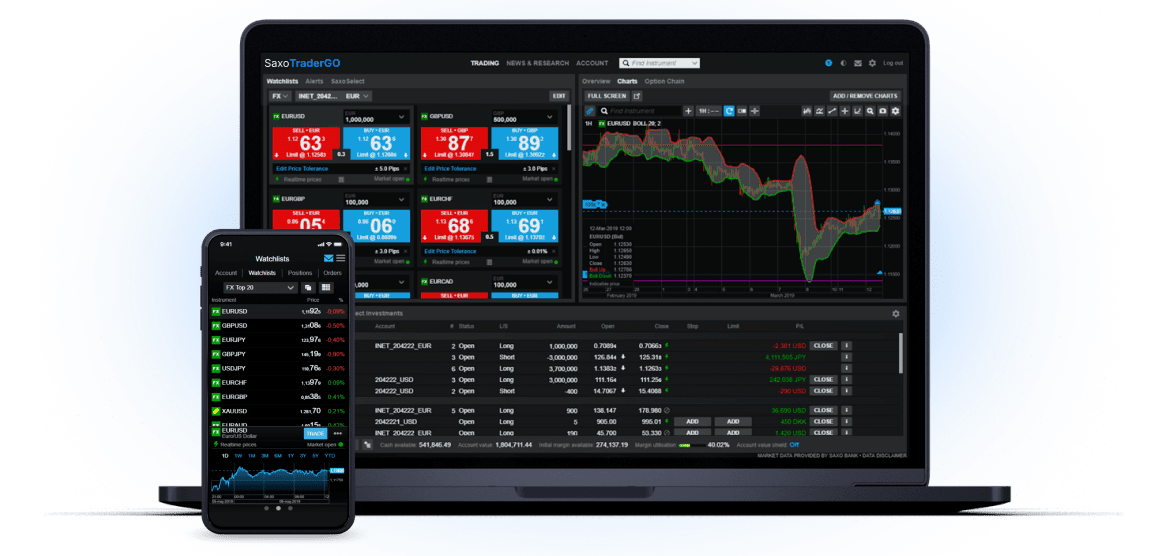

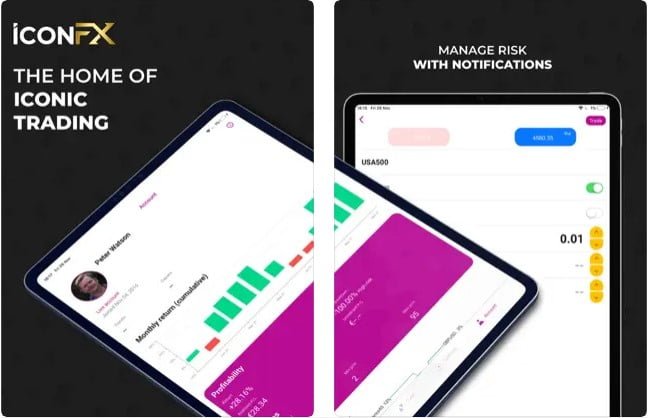

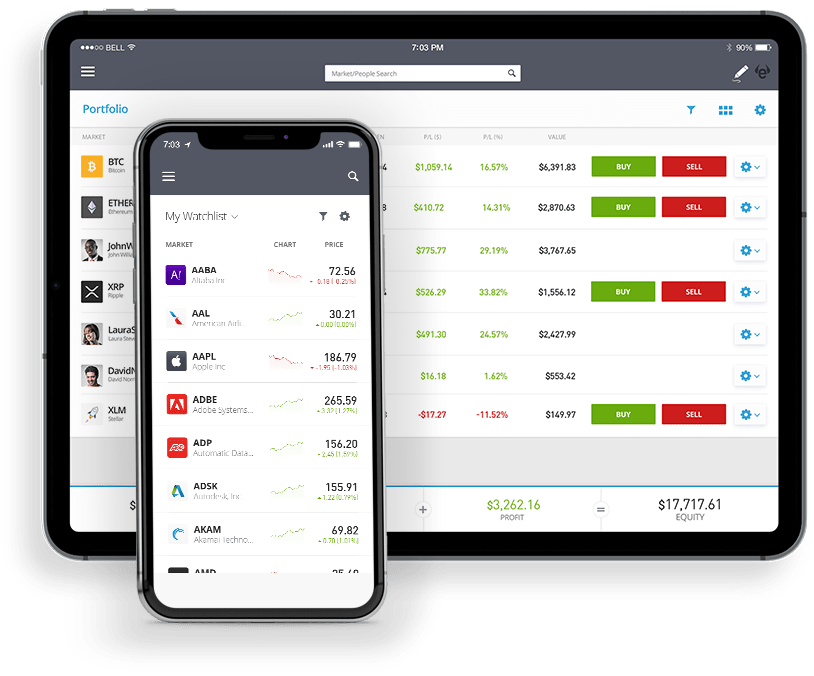

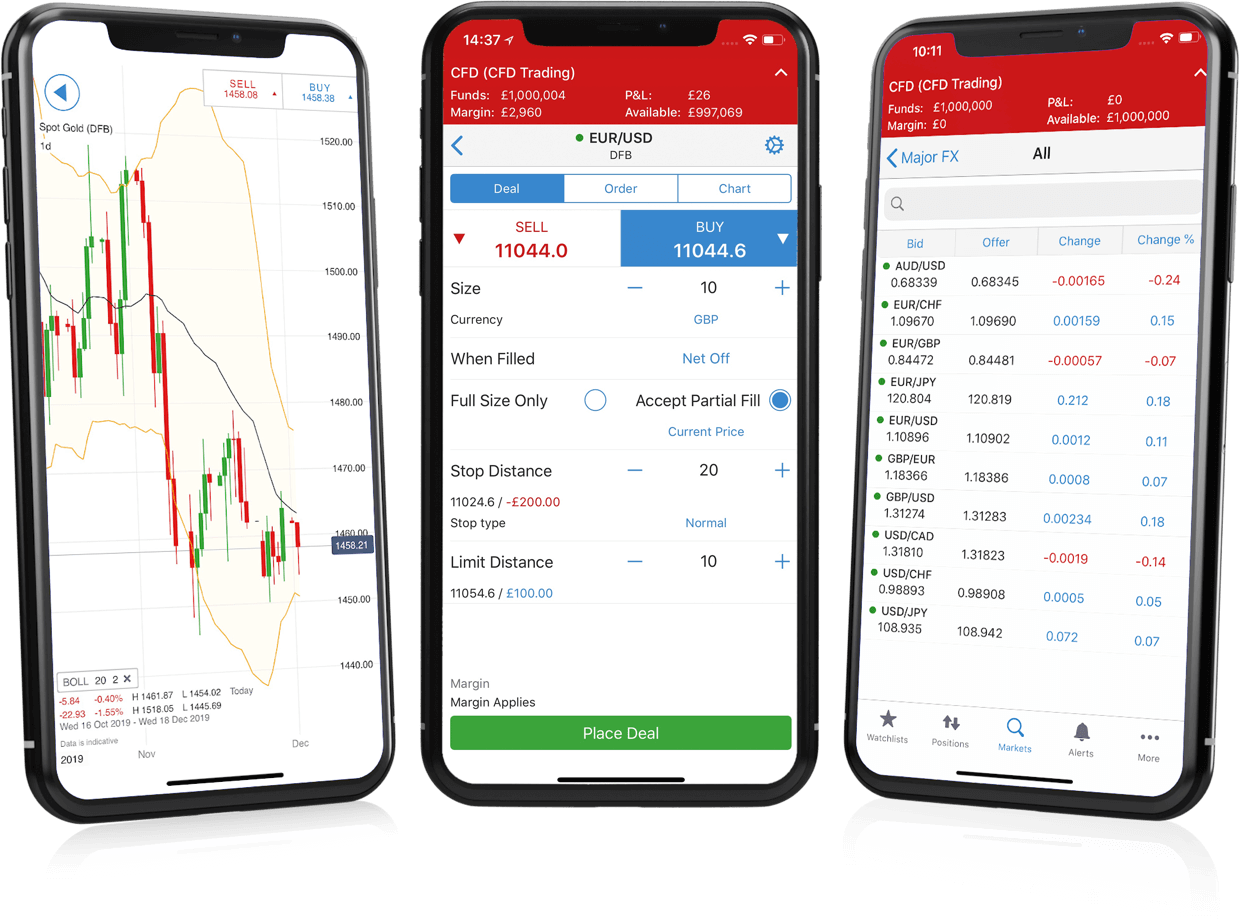

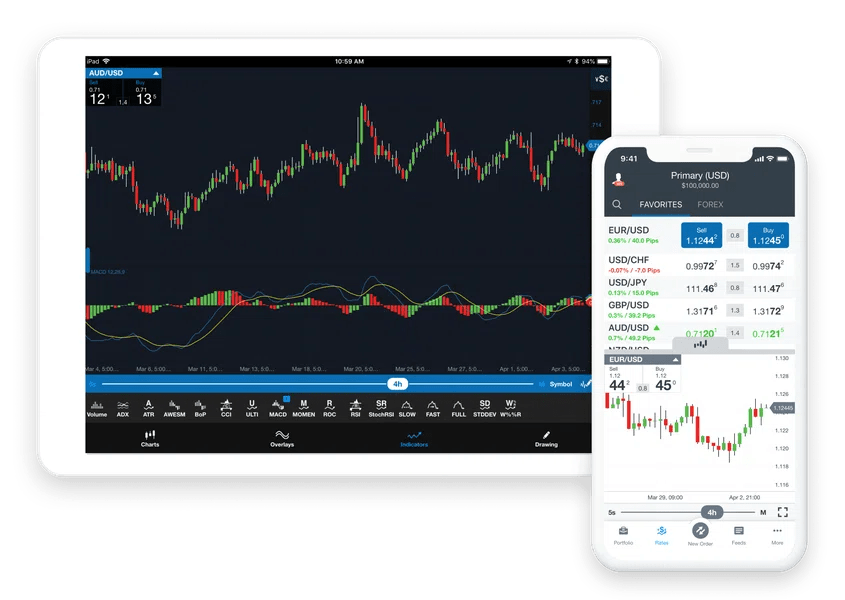

Further, forex brokers are financial service companies that allow traders access to the forex markets with their trading platforms.

There are a large number of forex brokers that provide services to traders, and each of them comes with its benefits and drawbacks. Most of the brokers also provide great customer support, educational content, and assistive tools in addition to trading features.

Beginner tip: When choosing a forex broker go for a beginner-friendly exchange to start your career so you will be able to navigate the platform easier and do trades more comfortably. We have reviewed some beginner-friendly brokers that you might want to check out.

FAQs

Understanding the basics and simple strategies in the forex field is not that difficult. But if you want to become an advanced trader, you will find that Forex is a pretty complex subject.

For the average retail trader, becoming rich off of forex trading alone will take quite some time. But for large-scale traders with deep pockets, Forex can be very profitable.

No. You do not need to invest a large amount of money in starting Forex.

Conclusion

Forex is a trading asset class that keeps rising in popularity. It allows traders to choose and trade pairs of currencies to make a profit in a highly liquid market, increasing the potential for profits.

Before diving head first into the forex market, new traders must first understand the basics of the trade. In this article, we cover the most common and starter knowledge necessary to start trading Forex.

When you feel like you have enough knowledge, create a demo account and test your skill in real-world scenarios to see if you got what it takes to make profitable trades. In our opinion that is the best way, you can get the perfect start for your forex trading career.