5 Key Insights on Pakistan Afghanistan War Market Impact Today

Table of Contents

The Pakistan Afghanistan War Market Impact is sending shockwaves across global financial markets. On February 27, 2026, Pakistan launched multiple airstrikes on Afghanistan, escalating a conflict that had been simmering for months. This marks a significant intensification of hostilities, prompting widespread concern among investors, traders, and policy makers worldwide.

For forex and commodity traders, these developments highlight the importance of partnering with a reliable broker like Icon FX. With real-time market access, advanced risk management tools, and 24/7 support, Icon FX equips traders to navigate heightened market volatility effectively.

Immediate Market Reactions

The Pakistan Afghanistan War Market Impact is evident across multiple asset classes:

- Equities: The benchmark indices in Pakistan and surrounding markets have fallen sharply as risk-off sentiment takes hold. Investors are selling riskier assets and reallocating to safe havens.

- Gold: Prices surged as traders sought refuge from geopolitical uncertainty. Gold continues to be a safe haven during crises.

- Japanese Yen (JPY): Strengthened against major currencies due to its risk-off status.

- Oil: Crude prices spiked as fears of supply disruptions in the region increase.

Traders who stay alert to these trends can use platforms like Icon FX to act quickly on live market data, hedging risks or seizing short-term trading opportunities.

Forex Movements to Monitor

The Pakistan Afghanistan War Market Impact has significantly affected currency markets. Key developments include:

- USD/PKR volatility is increasing amid concerns about Pakistan’s economic stability.

- Regional currencies like the Afghan Afghani are experiencing heightened fluctuations.

- Safe-haven currencies, including USD, CHF, and JPY, are attracting capital inflows as traders hedge against geopolitical risks.

Forex traders need a broker that offers both stability and execution speed. Icon FX provides competitive spreads, leverage options, and risk-management tools, allowing traders to protect positions in times of market turmoil.

Commodities and Oil Market Effects

Energy markets are especially sensitive to geopolitical events. The Pakistan Afghanistan War Market Impact is causing:

- Brent crude to rise on fears of supply disruption in the region.

- WTI crude reacting to instability, affecting global energy pricing.

Commodity traders can benefit from tracking supply-chain risk reports from sources like OPEC and IEA, while executing trades with a broker like Icon FX that offers real-time commodity CFDs and leveraged trading.

Trading Strategies Amid Volatility

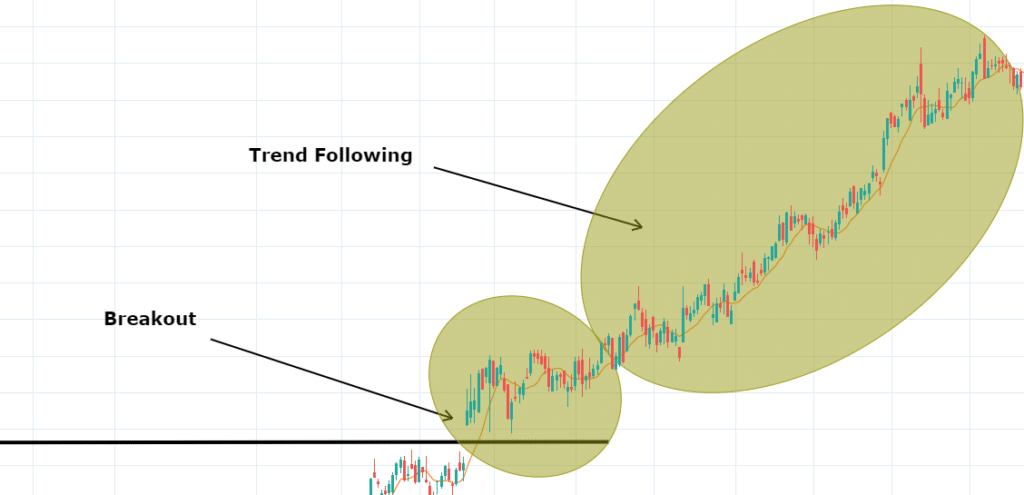

Traders can adopt specific strategies to mitigate risks and capitalize on market movements caused by the Pakistan Afghanistan War Market Impact:

- Diversify Portfolios: Include safe-haven assets like gold, treasury bonds, or stable currencies.

- Use Risk Management Tools: Stop-loss and take-profit orders help contain potential losses.

- Monitor News Closely: Geopolitical developments can drive rapid market swings.

- Leverage Real-Time Trading Platforms: Platforms like Icon FX provide the execution speed and analytical tools necessary during volatile periods.

These strategies help traders navigate sudden market shocks while staying prepared for the next wave of volatility.

Broader Economic and Market Implications

The Pakistan Afghanistan War Market Impact has wider implications beyond immediate trading:

- Trade Disruption: Border closures and instability have interrupted key trade routes, affecting exports and imports.

- Investor Confidence: Regional instability often leads to capital outflows, affecting stock and bond markets.

- Global Spillover: Investors in Asia, Europe, and even the U.S. respond to risk perception, influencing global equities, commodities, and currencies.

Forex traders using Icon FX can track these trends and adjust positions across multiple asset classes efficiently, ensuring they remain responsive to both regional and global market signals.

Conclusion

The Pakistan Afghanistan War Market Impact highlights the direct link between geopolitical conflicts and market volatility. Traders and investors must remain vigilant, focusing on safe-haven assets, robust risk management, and timely information.

For forex traders, partnering with a trusted broker like Icon FX ensures access to the tools and resources needed to respond to market shocks quickly. Whether it’s monitoring currency pairs affected by the conflict, trading commodities like gold and oil, or executing risk-managed strategies, Icon FX provides the infrastructure to trade confidently during periods of uncertainty.