5 Best Forex Trading Strategies For Beginners

A good plan is essential to make good profits from your forex trades, and forex trading strategies are the best way to go about it. Whether you are a beginner or a professional trader, you can benefit massively from a profitable strategy.

However, no forex trading strategy gives you 100% results. Some work better in certain markets, and all will require different levels of technical and fundamental analysis. This is why you need to understand your trading style and choose the right trading strategy for your situation.

Continue to read as we share some of the best forex trading strategies out there and how to pick one for yourself.

What is a Forex trading strategy?

Forex trading is all about making the correct decisions and placing trades to earn the maximum profit. A lot of factors go into the decision-making, and each can affect the result differently.

To make the process easy, traders have come up with various techniques that help them to determine whether to buy or sell a currency pair at any given time. These are what we call forex trading strategies. These forex trading strategies can be based on news-based events, trends, and fundamental or technical analysis.

Furthermore, trading strategies also act as a set of rules that inform traders about the trading and investment plan, risks, entry and exit rules, and the ideal time to trade.

Rather than doing impulse trading, following a strategy has proven to bear better results for the trader. Also, beginner and new traders can expect better sustainability in the market when following effective forex trading strategies.

Why do you need a Forex trading strategy?

When it comes to forex trading strategies, there are a large number of them available for you to choose from. The reason for implementing a strategy can vary from one trader to another. Let’s take a look at some of the most common reasons for choosing to follow a forex trading strategy.

What is a winning Forex trading strategy?

With a large number of available and newly created forex trading strategies, selecting a winning strategy can be a bit tricky. But there are a few ways that you can follow to find a profitable trading strategy.

1. The average win is greater than the average loss

When the strategy can generate more winning positions than losing positions, the average win becomes greater than the loss. These are the most effective and best-performing forex trading strategies. Because of that, these are also the hardest to find.

2. Yields more losing positions than winning ones, but the average win exceeds the average loss.

The problem with this type of forex trading strategy is that they have a high chance of average loss exceeding profits. While there are instances that this type of strategy can work, it comes with very high risk.

3. The average loss exceeds the average win

The final type of winning strategy is the one where the average loss exceeds the average win while generating more winning than losing positions. The important part is the net result of these strategies is on the positive side. Since forex trading commonly results in an average loss exceeding the gain, a strategy like this one will work perfectly. This is a forex trading strategy whose high rate of success offsets the profit-loss gap of forex trading after some time.

How to choose the right Forex trading strategy?

The trading strategy that is most suited to each trader can vary depending on the requirement. For example, while some traders are looking for long-term strategies, other traders might look for short-term compatible strategies. In cases like this, you should know how to choose the perfect strategy for you. Let's see how.

5 Forex trading strategies for beginners

Since we now know what a forex strategy is and why you need one, and how to choose one, let's take a look at some of the best strategies available.

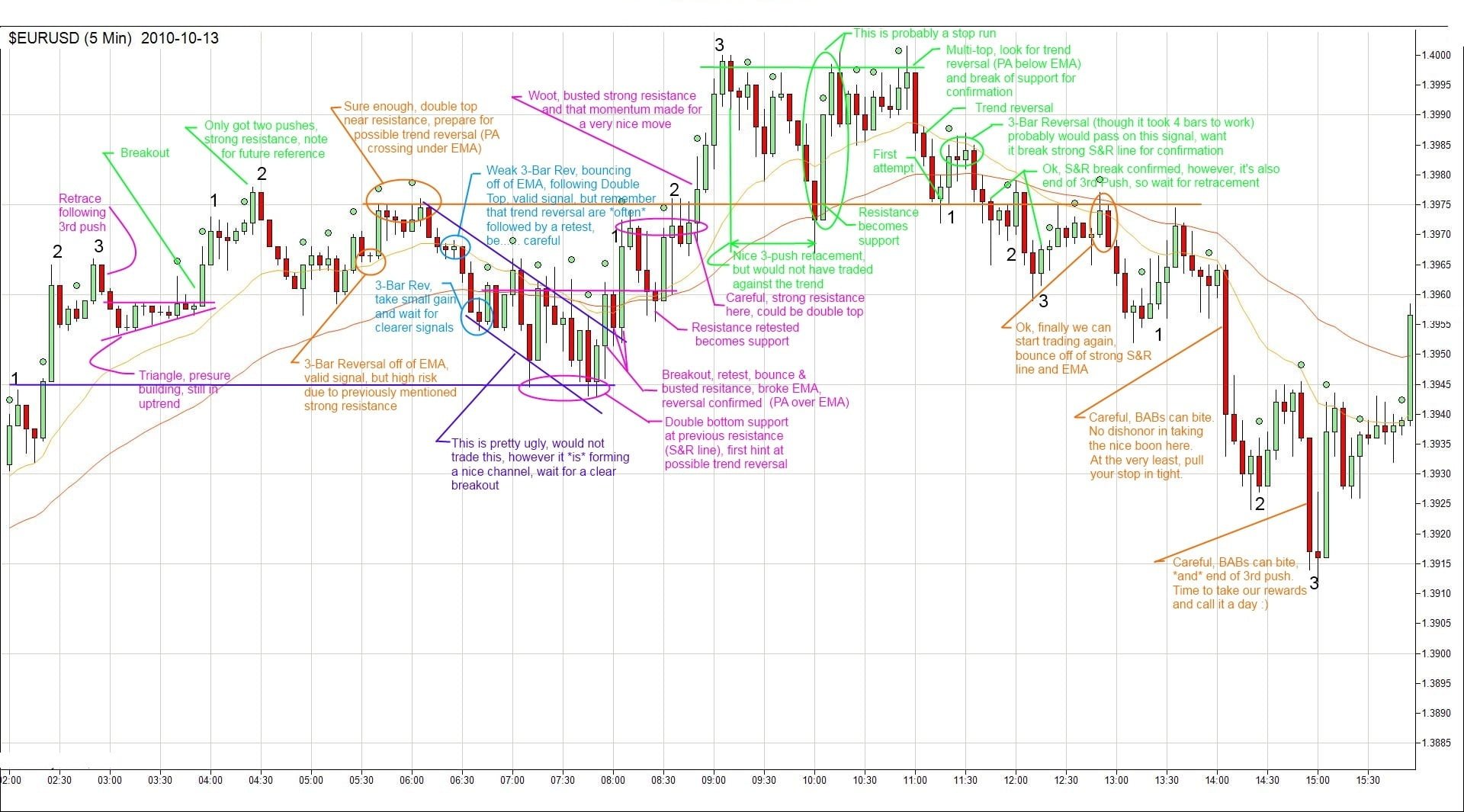

Price action trading

Price action is a trading strategy that involves making decisions based on the price movement of a certain asset. Traders can study historical prices to create a strategy that can be used alone or in conjunction with an indicator.

A great factor about price action trading is the flexibility it offers when it comes to the length of the trade and entry/exit points. Traders can use this forex trading strategy in long, medium, or short-term traders without any worries.

Pros

Cons

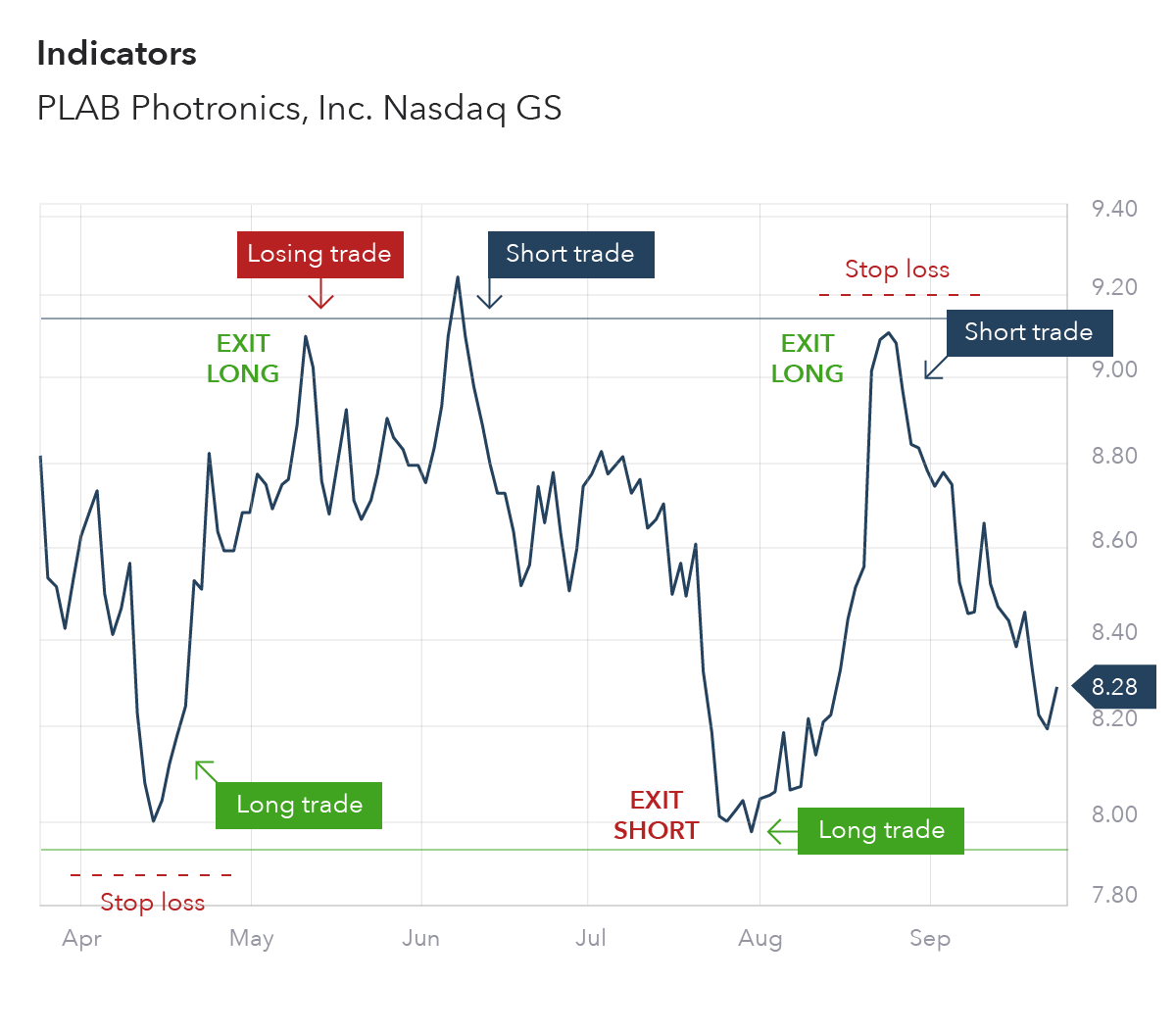

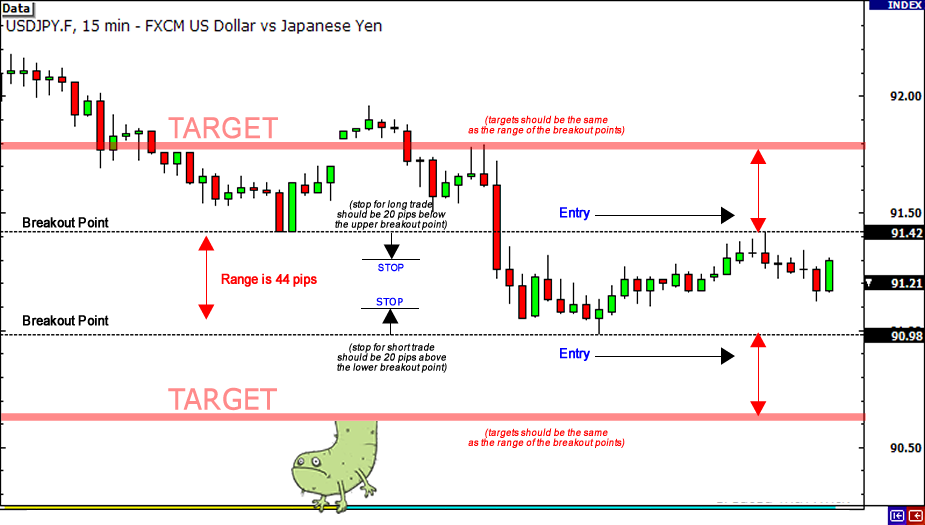

Range trading strategy

Utilizing the trading instruments that are consolidating in a certain range to build up a strategy is how this works. In addition, traders will need to identify non-trending instruments and support and resistance points on which they will place trades. Furthermore, the spread pip range differs according to the timeframe, and technical analysis helps to build this strategy.

This strategy works fine on any timeframe, and the usage of Oscillators can be seen as timing tools. Since there is a high chance of breakouts, managing risks is an important part of this strategy.

Pros

Cons

Day trading Strategy

Day trading focuses on trading forex pairs within the same day by closing all positions before the market closes. This strategy is suited for traders who don’t like much pressure along with their trades and take on only a few good opportunities.

The length of the trades can be anywhere from minutes to hours, as long as it closes within the day. Keeping an eye on an instrument and jumping on the perfect opportunity, and closing at a high point before the day end is what day traders usually do.

Pros

Cons

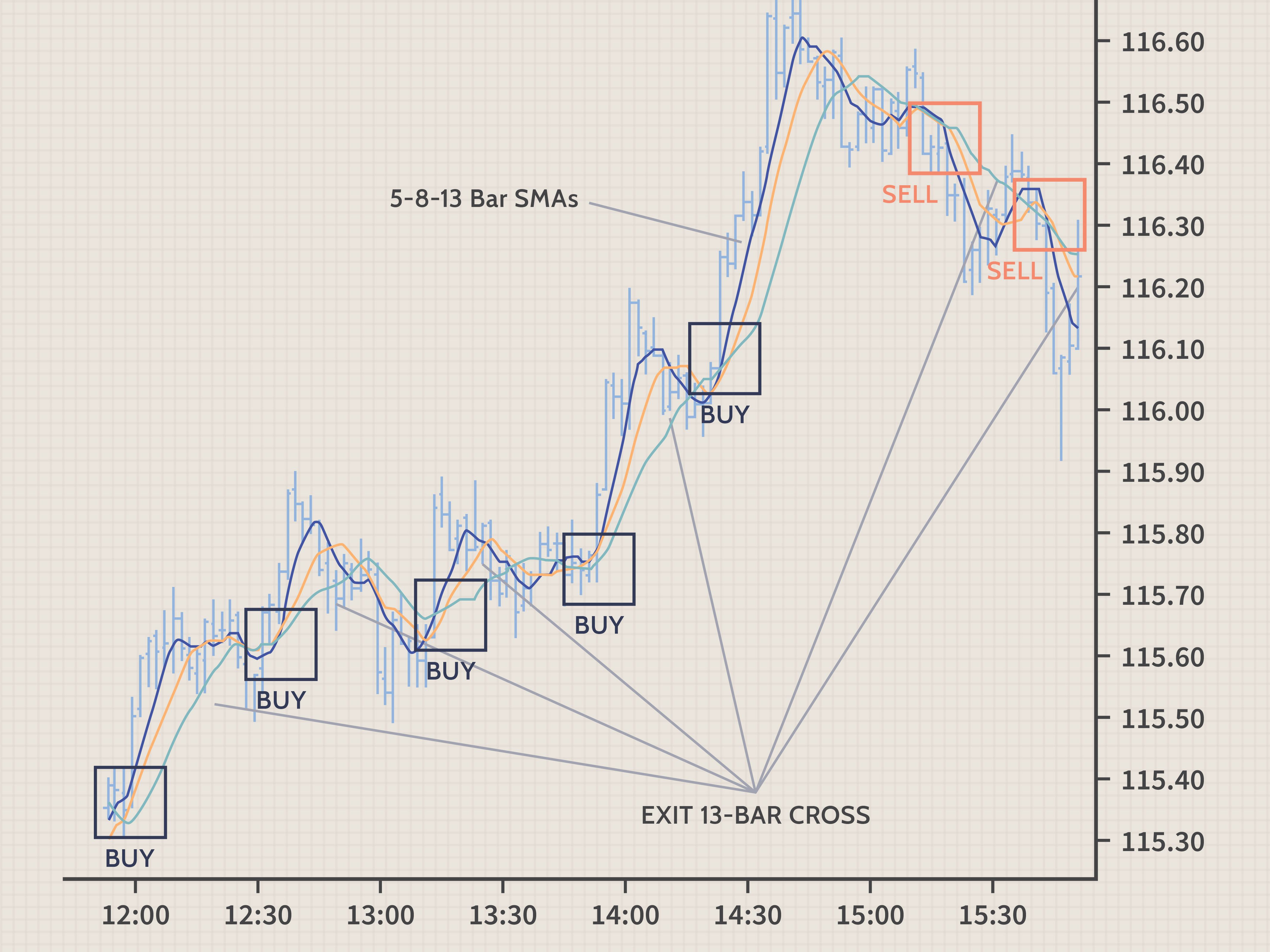

Scalping Trading

Traders who practice this forex trading strategy always try to take advantage of intraday price movements, regardless of their scale. Furthermore, the goal of this strategy is to earn small profits frequently by doing a large number of trades. In addition, the higher the liquidity of a forex pair, the better for scalpers as they offer very low spreads.

This type of trade usually takes around minutes to seconds and is most likely to happen multiple times a day. By identifying trends and using key levels as support and resistance bands, traders can go about forex scalping.

Pros

Cons

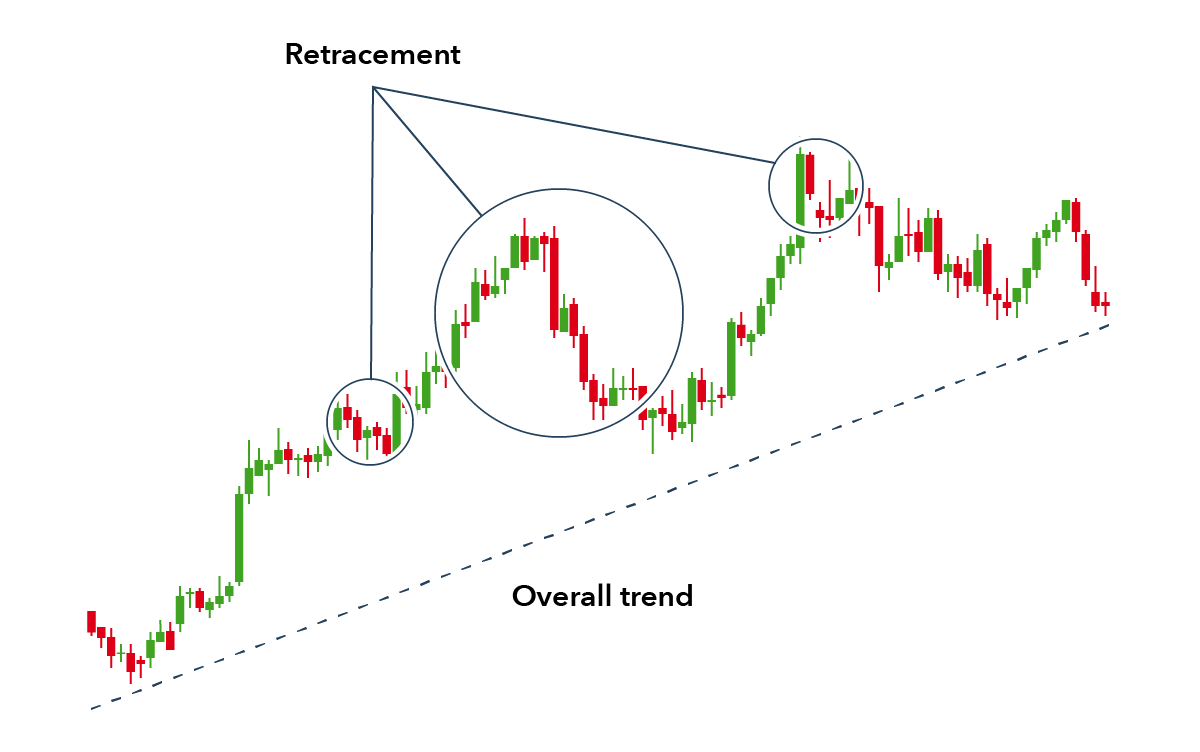

Trend trading strategy

This forex trading strategy follows identifying trading opportunities depending on the current trends in the market. This strategy assumes that the price movement of a certain forex pair will move in the same direction as the trend.

Trades that follow this forex trading strategy take a medium to long-range form and can change according to the status of the trend. In addition, Oscillators are used in deciding the entry points.

Pros

Cons

Conclusion

Perusing a forex trading strategy is the best way to get consistent results in the long run if you want to become a professional trader in Forex. However, there is no such thing as the best forex strategy. You might have to modify your strategy as time passes to fit the trends or even combine different strategies together to optimize the results.

Whether you are trying out a forex trading strategy that you found on the internet or developed one by yourself, you must test it out first in different conditions to see its performance before betting your money on it.

We hope this article will broaden your knowledge of different trading strategies and help you pick a strategy for your trades.

FAQs

Most people consider trend trading as a reliable forex trading strategy. This strategy is quite simple and enables users to engage in medium to long-range trades.

Beginners will have a much easier time following the Trend or Range trading strategy. Both of these do not come with a steep learning curve.

Yes, you can. But doing impulse trading without following a strategy has a much higher chance of failure in the long run.